ADA Parking – 5 Essential Questions for Property Managers

ADA accessibility violations are on the rise at commercial properties across the country. The best way to ensure your property is safe and accessible is to be proactive and remain compliant. A great place to start is on the parking lot.

What is my responsibility as a property owner?

In many circumstances, the property owner will be responsible for ADA compliance and violations. Tenants are not held liable for ADA violations that occur in areas exclusively under control of the landlord, unless otherwise noted in the leasing agreement to the tenant. The landlord, as the property owner, has potential ADA public accommodation liability for the entire property – including the common areas and any property that is occupied by the tenant.

What are common ADA violations in the parking lot?

- Inadequate number of ADA parking spaces – The minimum number of accessible parking spaces required depends on the total number of parking spaces in the lot. Consult the table on adata.org/factsheet/parking for details. Certain types of medical facilities need more accessible parking. Hospital outpatient facilities need 10% of patient/visitor space to be accessible. Rehabilitation facilities that specialize in treating mobility-related conditions and outpatient physical therapy facilities need 20%. The number of van accessible spaces is still one for every 6 accessible parking spaces, or fraction thereof.

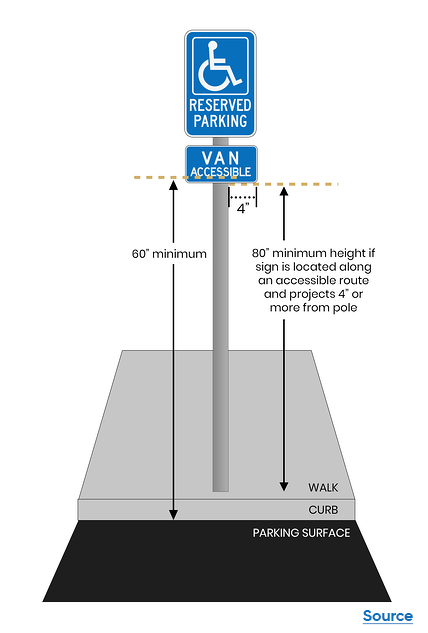

- Improper height of ADA signage – Parking space identification sign with the international symbol of accessibility must be mounted 60 inches (5 feet) minimum above the ground surface measured to the bottom of the sign.

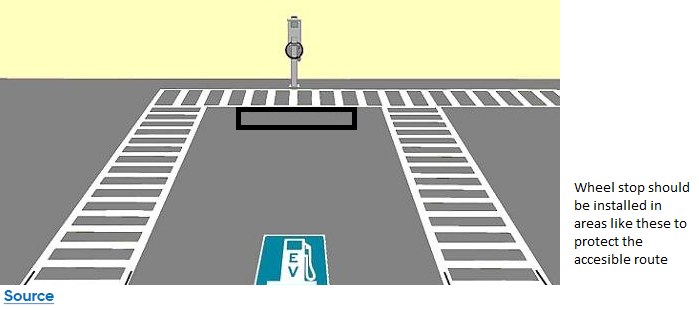

- Missing wheel stops – If the accessible route is in front of the parking space, install wheel stops to keep vehicles from reducing the clear width of the accessible route below 36 inches (3 feet).

- Improper slope – Federal guidelines for slope of a curb ramp, or any accessible route, may not exceed 2%.

- Missing wayfinding signage – If there is more than one entrance and only one is accessible, a sign must be posted at each inaccessible entrance directing individuals to the accessible entrance. This entrance must be open whenever other public entrances are open.

What financial resources are available for ADA remediation?

There are tax breaks to assist small businesses in complying with ADA, to meet the criteria for tax breaks you must have 30 or fewer full-time employees or have revenue of $1 million or less in the previous tax year. Eligible expenses may include the cost of undertaking barrier removal to improve accessibility. Outside of small business tax breaks, Section 190 of the IRS code provides a tax deduction for businesses of all sizes for costs incurred in removing architectural barriers in existing facilities. The maximum deduction is $15,000 per year.

What else do I need to know?

The federal ADA regulations are the bare minimum to be compliant; in some cases, local regulations may be more stringent and should be checked before proceeding with any remediation or repairs.

Who can help:

Let’s Pave can help make your parking lot compliant. Our ADA experts have reviewed thousands of parking lots and performed ADA remediation at numerous sites. We understand the federal laws and perform due diligence to ensure your parking lot also meets local regulations. The result is a safe and accessible parking lot, which reduces the potential for lawsuits or costly violations. Ready? Let’s comply!